High-risk businesses are not any “bad” kind of business. On a contrary, when handled in a right way, the high-risk business will mean very high profits for bank, processors as well as merchants themselves. The high-risk merchants generally have the superior access to the internationals markets & unlimited processing. When we look over what makes your business high-risk, then you will see where you can mitigate any drawbacks &maximize returns of the designation.

When you identify high risk companies platform singapore, you businesses won’t be able to secure the standard account with acquirers. They may instead need to go with the high risk merchant that generally means that business may incur many restrictions and high processing fees, which can adversely affect your bottom line.

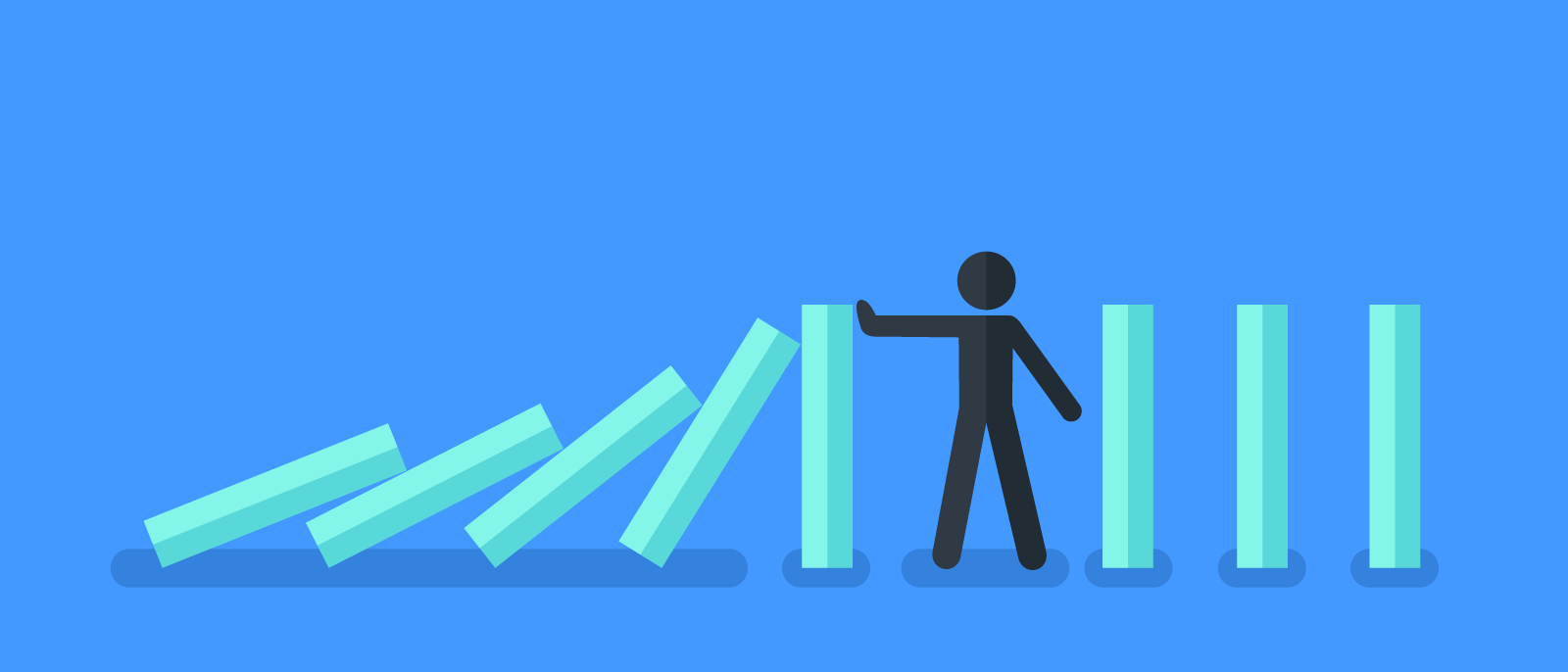

Merchants who select to sell things, which are considered high risk products may have the tough time avoiding negative repercussions that are doled out by the acquirers & processors. But, merchants who provide ‘safe’ products or services will avoid label of the high risk—however only if the chargebacks are successfully managed.

Why your business is labeled as high-risk

In a way you run the business may place you in a “high risk” category. So, here are some factors that will make your business a high-risk business:

- Multi-currency businesses

- Businesses with no credit card history

- Businesses lost the last processor account due to excessive chargebacks & are branded terminated merchant file

- Businesses operating overseas and with countries having high chargeback risk

- Bad credit history